Optimize Your Tax Obligation Reductions With a Simple and Reliable Gas Mileage Tracker

In the world of tax reductions, tracking your mileage can be an often-overlooked yet essential task for optimizing your financial advantages. Understanding the subtleties of effective gas mileage monitoring may reveal methods that can substantially impact your tax obligation situation.

Importance of Mileage Monitoring

Tracking mileage is vital for anyone seeking to maximize their tax obligation reductions. Accurate mileage tracking not just guarantees conformity with internal revenue service laws yet also enables taxpayers to benefit from deductions connected to business-related traveling. For independent people and company owner, these deductions can substantially lower gross income, thus decreasing total tax obligation liability.

Furthermore, maintaining a comprehensive document of mileage assists differentiate between personal and business-related trips, which is important for corroborating insurance claims during tax audits. The internal revenue service calls for certain documents, consisting of the day, destination, objective, and miles driven for each journey. Without precise records, taxpayers risk shedding beneficial reductions or encountering penalties.

In addition, reliable mileage tracking can highlight fads in traveling costs, assisting in far better economic preparation. By assessing these patterns, people and businesses can identify opportunities to maximize travel routes, minimize expenses, and enhance functional effectiveness.

Choosing the Right Gas Mileage Tracker

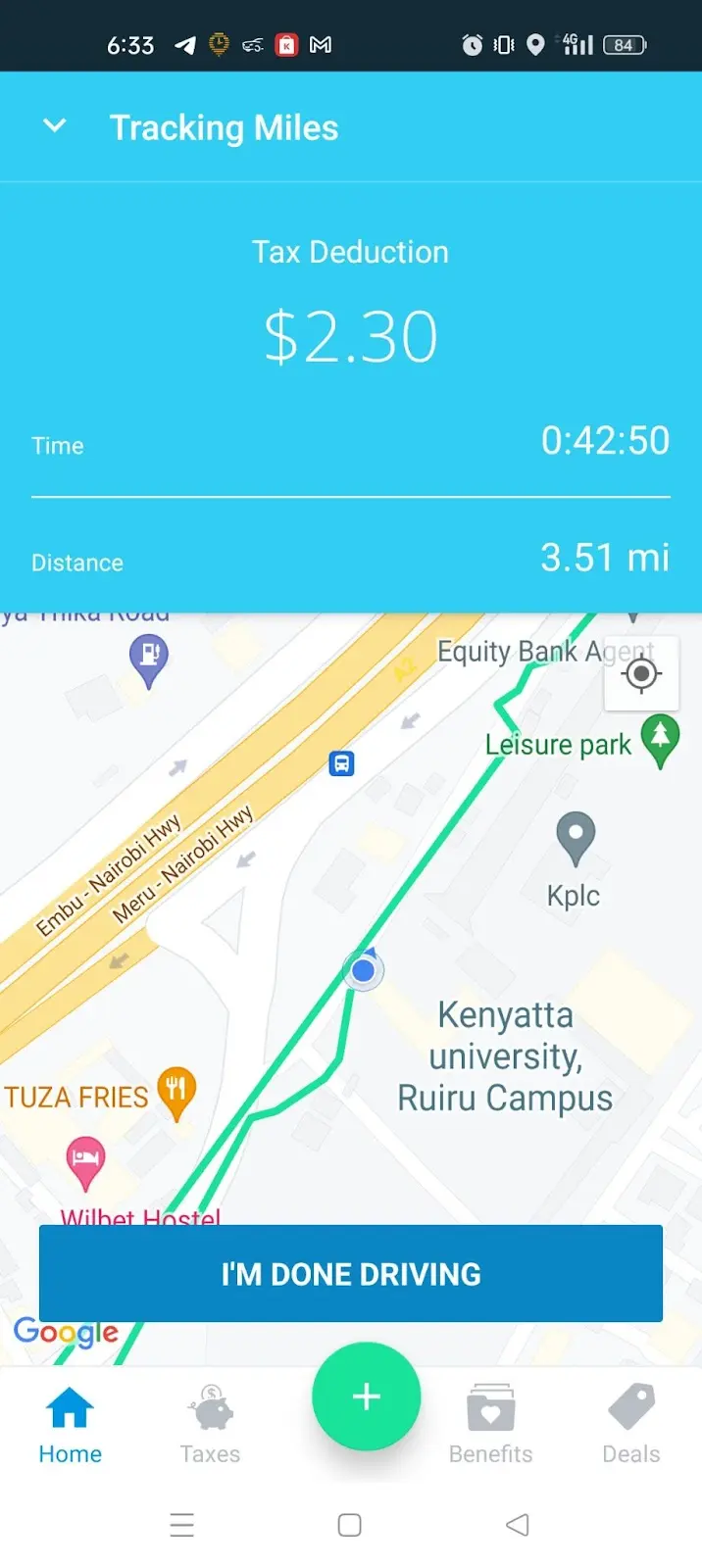

When choosing a gas mileage tracker, it is necessary to think about numerous functions and performances that align with your certain requirements (best mileage tracker app). The first facet to assess is the method of monitoring-- whether you like a mobile app, a general practitioner gadget, or a manual log. Mobile applications commonly offer convenience and real-time monitoring, while GPS devices can supply even more accuracy in range measurements

Following, examine the combination capacities of the tracker. A good mileage tracker need to seamlessly integrate with audit software or tax prep work devices, enabling uncomplicated data transfer and reporting. Search for functions such as automated monitoring, which minimizes the requirement for hands-on access, and categorization choices to compare company and individual journeys.

How to Track Your Mileage

Choosing a proper gas mileage tracker establishes the structure for reliable gas mileage monitoring. To properly track your mileage, begin by identifying the purpose of your travels, whether they are for company, charitable activities, or medical reasons. This clearness will certainly aid you classify your journeys and ensure you capture all appropriate information.

Next, regularly log your mileage. If utilizing a mobile application, enable location services to immediately track your trips. For hands-on entrances, record the beginning and finishing odometer analyses, along with the date, purpose, and path of each trip. This level of detail will certainly prove vital throughout tax obligation period.

It's additionally important to frequently examine your access for precision and efficiency. Set a you can find out more schedule, such as weekly or month-to-month, to settle your documents. This method assists avoid inconsistencies and ensures you do not overlook any kind of insurance deductible gas mileage.

Finally, back up your records. Whether digital or paper-based, keeping back-ups safeguards versus information loss and assists in simple gain access to during tax obligation prep work. By vigilantly tracking your mileage and keeping organized documents, you will prepare for optimizing your prospective tax deductions.

Making Best Use Of Deductions With Accurate Records

Exact record-keeping is important for optimizing your tax reductions related to gas mileage. When you maintain in-depth and precise documents of your business-related driving, you create a robust structure for claiming deductions that might considerably decrease your taxable earnings.

Making use of a gas mileage tracker can simplify this process, enabling you to log your journeys effortlessly. Lots of applications automatically determine ranges and categorize journeys, saving you time and reducing errors. Furthermore, keeping supporting paperwork, such as invoices for relevant expenditures, strengthens your case for deductions.

It's crucial to be constant in videotaping your gas mileage. Eventually, precise and organized gas mileage records are essential to optimizing your reductions, ensuring you take complete advantage of the possible tax obligation benefits readily available to you as a service chauffeur.

Usual Errors to Prevent

Maintaining thorough documents is a considerable step toward making the most of gas mileage reductions, however it's equally important to be aware of usual errors that can weaken these efforts. One prevalent mistake is failing to record all journeys precisely. Even minor business-related trips can include see it here up, so disregarding to videotape them can result in considerable lost deductions.

Another mistake is not differentiating between individual and service mileage. Clear categorization is essential; blending these 2 can set off audits and lead to penalties. In addition, some people fail to remember to keep sustaining papers, such as invoices for associated expenses, which can better verify claims.

Utilizing a gas mileage tracker application guarantees constant and trusted records. Familiarize yourself with the most current laws regarding mileage deductions to prevent unintended mistakes.

Verdict

In conclusion, effective mileage tracking is important for making best use of tax reductions. Utilizing a reputable gas mileage tracker streamlines the procedure of taping business-related journeys, guaranteeing accurate documentation. Regular evaluations and backups of mileage records Source enhance compliance with IRS regulations while supporting educated economic decision-making. By staying clear of usual challenges and preserving precise records, taxpayers can considerably decrease their overall tax responsibility, inevitably profiting their economic health and wellness. Carrying out these methods fosters a proactive strategy to handling overhead.

Comments on “Upgrade Your Travel Records with a Mileage Tracker App That Simplifies Mileage Logs”